The Labour Party claims National’s tax plan “does not add up and will make life harder for Kiwis.”

National’s Back Pocket Boost tax relief plan will increase after-tax pay for the “squeezed middle” making a family with kids, on the average income of $120,000, up to $250 a fortnight better off, and an average-income child-free household up to $100 a fortnight better off.

National announced:

-

Up to $250 more per fortnight for an average-income family with children

-

Up to $100 more per fortnight for an average-income household with no children

-

Up to $20 more per fortnight for a full-time minimum-wage earner, and lowering the tax they pay for additional hours worked

-

Up to $26 more per fortnight for a superannuitant couple.

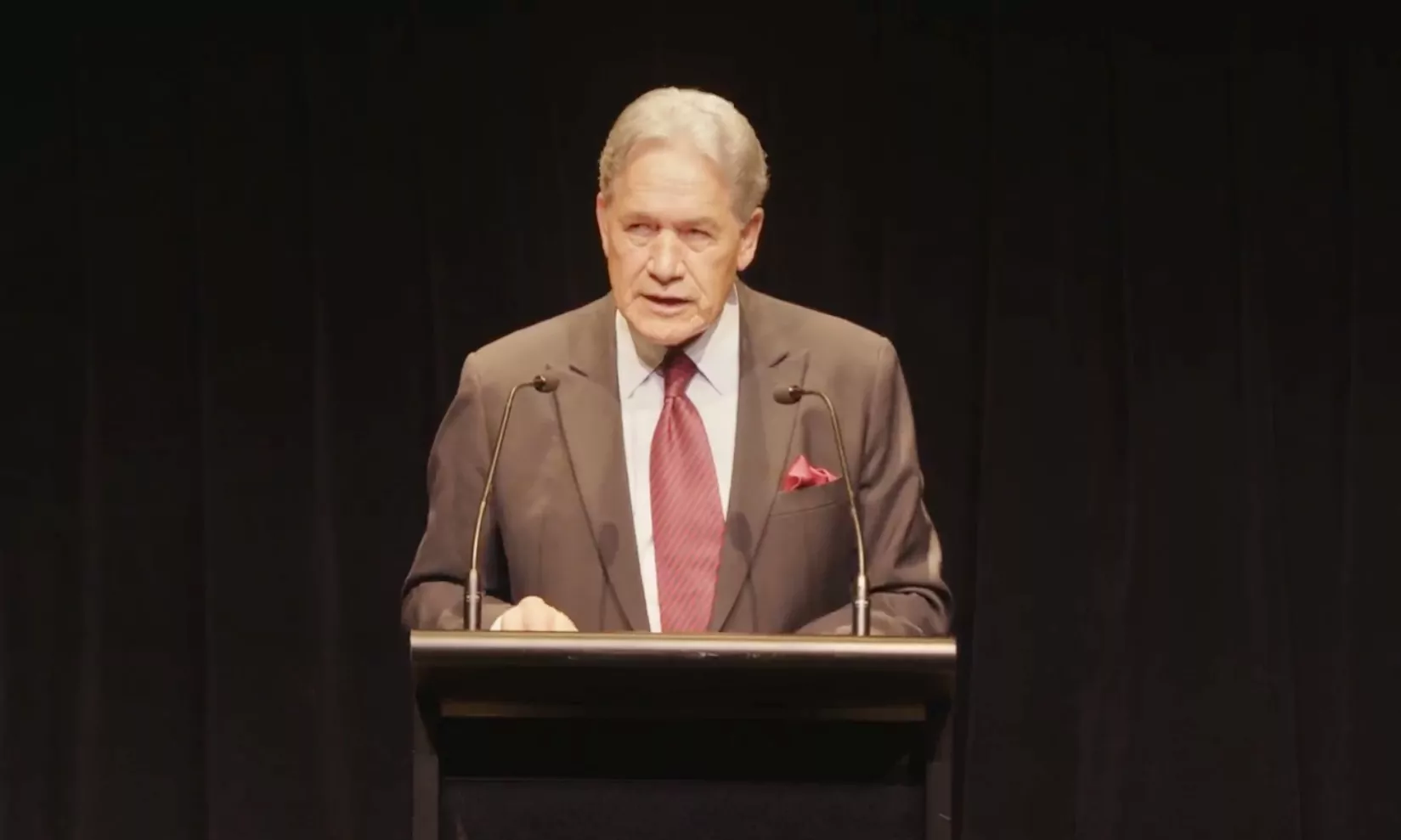

But Grant Robertson said “National’s dodgy tax plan will make many families worse off through their cuts to early childhood education, cheaper public transport and public services.

“Their tax and burn plan will also pour petrol on the housing market that Labour has worked hard to rein in.

“National’s cuts to the public services are more than double those the Government announced on Monday.

“National will be asking for 8 percent cuts in many agencies and therefore they will not be able to protect frontline services. Despite what they say, the fine print of their document says health and education will be cut to find savings.

“National is laying out some voodoo costings today with their claim to be able to grab $740 million per year from foreign buyers.

“The plan relies on more and more foreign buyers coming into the New Zealand market every year, despite putting a tax on them.

“It also beggars belief that there are that number of homes available every year to be bought up by foreigners to fund National’s tax cuts” Robertson said.