The Taxpayers’ Union has criticised the Govenment’s investment loss in SolarZero, a solar energy company that went into liquidation calling it a “disgraceful waste.”

The investment was made by the Crown-owned New Zealand Green Investment Finance (NZGIF), a fund established in 2019 under the Labour-led government of Prime Minister Jacinda Ardern to support low-emission projects.

Taxpayers’ Union spokesman James Ross said the government’s approach to public spending is flawed.

“When the government tries to gamble with taxpayers’ money, private companies line their pockets and taxpayers get the risk. Government picking winners doesn’t work,” he said.

SolarZero’s most recent government-backed funding came in July 2024, when it secured $195 million in debt facilities.

This funding was arranged by Société Générale under a credit-enhanced financing model provided through NZGIF’s Solar Finance Programme.

Ross said SolarZero’s collapse equates to $57 for every household in the country.

He added, “How much taxpayer cash do we have to waste before the government quits its gambling addiction? SolarZero’s collapse saw $115 million of taxpayers’ cash go up in flames.”

The NZGIF, initially funded with $100 million in 2019, received an additional $300 million in 2021 under the Labour-led government.

The fund was designed to bridge the gap between private capital and green initiatives, but its critics—including the Taxpayers’ Union—have raised concerns about oversight, risk, and the viability of its investments.

The Taxpayers’ Union also called the broader investment strategy “corporate welfare,” with Ross labelling it “bad investments, bad oversight, bad outcomes.”

The incident has led to increased scrutiny of NZGIF, particularly given the scale of its commitments, and is likely to prompt further debate over the use of public funds in private-sector initiatives.

However, A NZGIF spokesperson said “NZGIF and international lenders made asset-backed finance available so SolarZero could install panels and batteries on customers’ homes.

“Our exposure is tied to solar-as-a-service contracts in respect of those assets, which despite SolarZero’s voluntary liquidation, willcontinue. As such, solar energy will continue to be provided to customers. To be clear, lenders did not lend to SolarZero corporate.

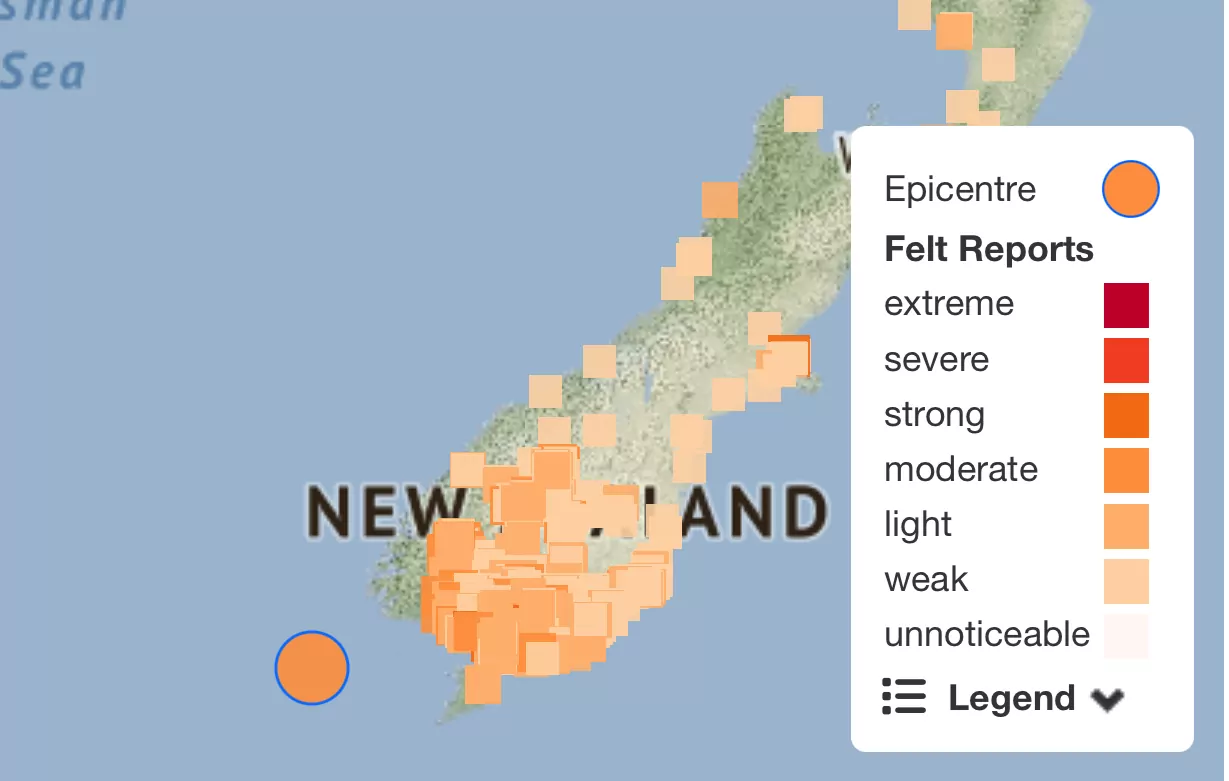

“The finance offered is through NZGIF Solar Finance, as outlined in the diagram below. A total of $365m from all lenders was available, but this was not fully drawn down at the point of SolarZero’s liquidation – and some had been repaid.

Supplied / NZGIF

“NZGIF’s total commitment under this programme is $145m. At the time of SolarZero’s liquidation, approximately $115m of NZGIF’s commitment was drawn down against installations.

“The liquidator’s initial report is due in the next few days. However, it may take some time to understand the final financial implications under a range of scenarios.

” NZGIF is working with the other lenders to understand the impact of the liquidation, how much debt will be repaid and over what period. The lender group has appointed external experts to advise.

Former Energy Minster Megan Woods said “It is really saddening and disappointing to hear about the liquidation of Solar Zero yesterday. There is still a lot of uncertainty around the situation, and we don’t know the full story.

“What I do know is that in order for innovative companies like this to succeed and ultimately for consumers to have lower power bills there needs to be strong leadership from Government.

I will be asking the Minister what he has done to keep the momentum on creating the flexible markets we need for innovation like this, and what impact his government’s scrapping of the Distributed Flexibility Innovation Fund and other effective climate action had on the failure of this company” Woods said.